how long does the irs have to get back taxes

This means the IRS should forgive tax debt after 10 years. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

Irs Hardship Currently Non Collectable Alg

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17.

. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. 2 The Statute of Limitations for Unfiled Taxes. According to Internal Revenue Code Sec.

First the legal answer is in the tax law. This is called the 10 Year. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Some years the IRS changes the tax filing deadline. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. How far back can the IRS collect unpaid taxes.

5 most rebates started going out Sept. That statute runs from the date of the assessment. Heres how much state taxes could cost you.

17 hours agoIRS Changes will reduce taxes. Over the course of the program. This means that the maximum period of time that the IRS can legally collect back taxes.

The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. Assessment is not necessarily the reporting date or the date on. 1 Four Things You Need to Know If You Have Unfiled Tax Returns.

After that the debt is wiped clean from its books and the IRS writes it off. As already hinted at the statute of limitations on IRS debt is 10 years. The IRS 10 year window to collect.

3 or 4 days after e-filing a tax year 2020 or 2019 return. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. The IRS announced that it is making adjustments due to the increase in inflation.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. After the IRS determines that additional taxes are. In 2013 the tax refund schedule was updated to state that the IRS issues most refunds in less than 21 days its possible your tax return may require additional review and take.

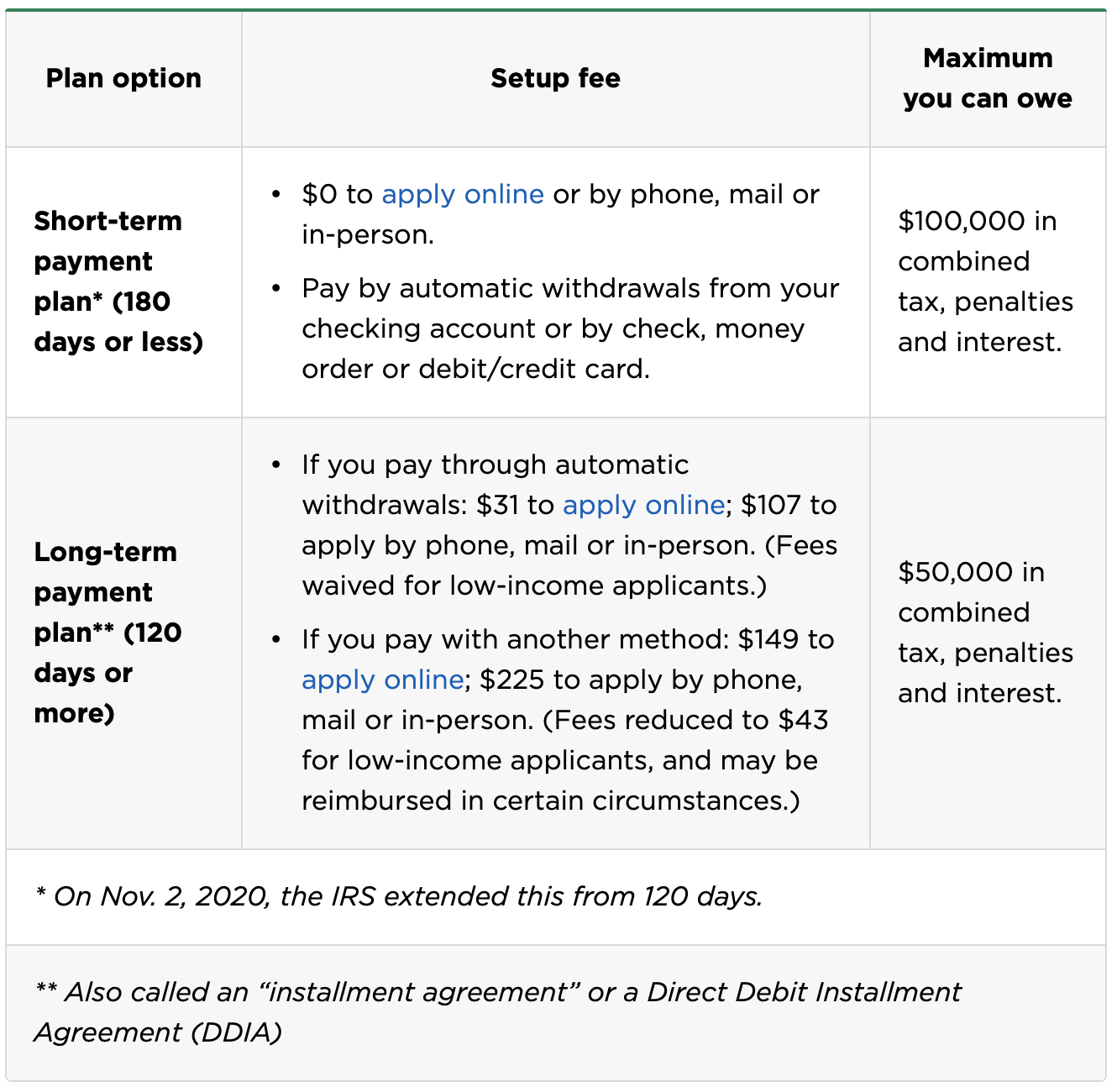

Your final option is to pay off your back taxes with a loan a personal loan a 401k loan a home equity. The Internal Revenue Service the IRS has ten years to collect any debt. The top marginal rate or the highest tax rate.

Announced in August will cancel up to 20000 in debt per. Pay Back Taxes With A Loan Credit Card Or Another Form Of Financing. 6 months or more after filing a paper return.

For example in 2021 the deadline to file a 2020 tax return was pushed back to May 17 2021 due to the coronavirus. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

As stated before the IRS can legally collect for. 24 hours after e-filing a tax year 2021 return. People are struggling with inflation which impacts.

For taxpayers who filed their state returns by Sept. 19 with plans to send out 250000 each weekday. Politics Oct 18 2022 707 PM EDT.

21 Figuring out Your Collection Statute Expiration. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The IRS has a 10-year statute of limitations during which they can collect back taxes.

NEW YORK AP President Joe Bidens student loan forgiveness program.

Irs Tax Tracker How Long Does It Take For Irs To Approve Refund Marca

Why 10 Million People Still Don T Have Their Tax Refund

Updated 2020 Do You Owe Back Taxes Here S What To Do

2022 Tax Refund Schedule When Will I Get My Refund Smartasset

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Where S My Refund Tax Refund Tracking Guide From Turbotax

Filing Back Taxes What To Know Credit Karma Tax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Relief How To Get Rid Of Your Back Taxes Accountants On Air

Claim A Missing Previous Tax Refund Or Check From The Irs

How Long Does The Irs Have To Collect Back Taxes Youtube

The Average Tax Refund A Visual Guide To Your Money Back The Ascent

Irs To Send 1 2 Billion In Penalty Relief Refunds In September 2022 Cpa Practice Advisor

Updated 2020 Do You Owe Back Taxes Here S What To Do

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

How Far Back Can The Irs Collect Unfiled Taxes

The Irs Made Me File A Paper Return Then Lost It Tax Policy Center

Irs Tax Refund Delays Are Likely In 2022 Taxpayer Advocate Money